Five guidelines for selecting the best charitable organization for your donation

By David Bakke

As of 2011, over 1 million tax exempt charitable organizations operated in the U.S. The prospect of combing through that list to find the one charity that best sums up your beliefs––and where your money can do the most good––is a daunting task. It’s important to conduct the appropriate research to ensure your charitable dollars are going to the right place, but there are easier ways to find the right match than looking for that needle in a haystack. If you’re currently struggling to find the proper charity for your dollars, here are five things to consider:

1. Use reputable online resources

If you want to learn more about a specific organization, that organization’s website may not be the best place to get it, as it’s more than likely going to present only positive information.

In addition, many of the websites that aggregate lists and manage databases may be out-of-date or just plain sloppy. Instead, research your favored charitable organizations at the Better Business Bureau’s (BBB) website or CharityNavigator.

2. Make sure the organization is IRS-approved

You can obtain a full list of all the organizations approved by the IRS as tax-deductible at irs.gov.

3. Investigate administrative costs

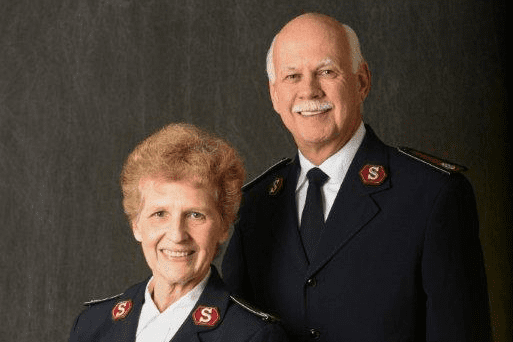

According to the American Institute of Philanthropy, administrative costs should be 40 percent or less to ensure a healthy charity, but you can certainly find lower than that. For example, according to the BBB, the administrative costs of The Salvation Army as a percentage of total revenue in 2010 were just slightly over 10 percent.

4. Contact the organization

It’s perfectly acceptable to contact the organization in person to find out more about where your dollars are actually going and if the organization is actually a charity or more of an advocacy group. Of course, there’s nothing wrong with donating to an advocacy group, but if the organization in question is one, your money may not go directly to those in need.

5. Review the privacy policy

If a charitable organization sells or provides your personal information to third-party organizations, and that’s a problem for you, stay away. Also see if they have a general policy of releasing donation information to the public, and make sure that’s something you’re comfortable with before signing that check.

Once you’ve decided on an organization, remember to follow the letter of the law regarding your tax deductions for charitable donations. For a complete list of the rules and regulations concerning charitable contributions, check out the IRS Publication 526.

The Salvation Army is a responsible steward of generosity in your community. According to The New York Times, the organization is “widely considered exemplary among nonprofits in handling cash collections.” You can be sure that 82 cents of every dollar The Salvation Army spends goes directly to support community service programs––far exceeding the BBB’s guideline of 65 percent.

To read this article in its entirety visit moneycrashers.com.